This week has potential

putting it all together

Greetings,

took me a bit longer this week.

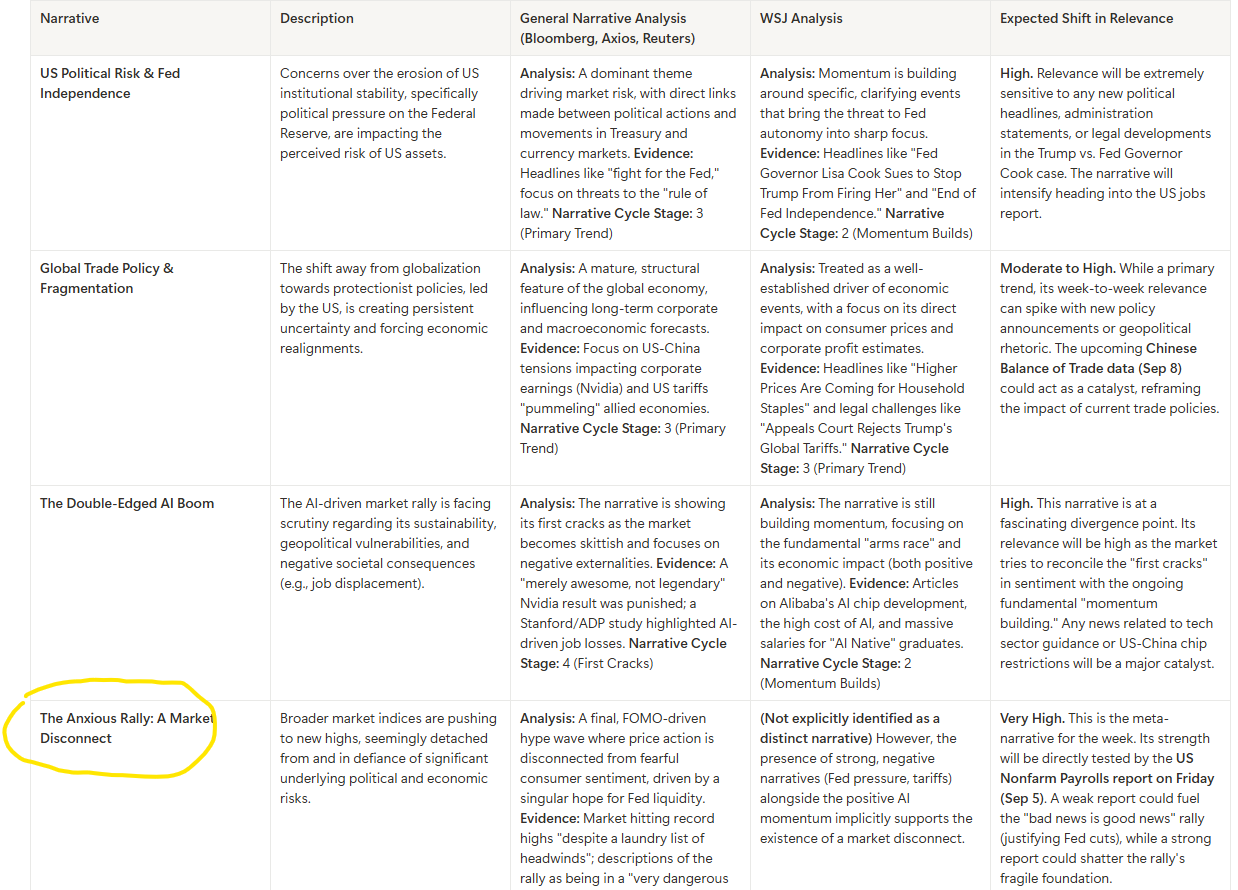

Check below the Narratives for this week. The last one is important

This hands us a important clue . Loóking at the Trading Opportunity 3 the Model found and carefully read the Risk Assessment :

(Trading Opportunity 3)

Trading Action: Utilize Volatility Instruments / Conditional Short

Instrument(s): Nasdaq 100 Futures, Tech Stocks (e.g., NVIDIA)

Rationale: The tech sector is caught between two powerful narratives: the fundamental AI build-out (AI-BOOM Stage 2) and the market's skittishness at peak valuations (AI-BOOM Stage 4, ANX-RALLY Stage 5). News reports consistently show that "good is not good enough" for earnings/guidance. This fragility makes the sector highly susceptible to a reversal on any negative catalyst or a broader market risk-off event.

Time Sensitivity: Short-term.

Confidence Level: Medium

Narrative Alignment: AI-BOOM, ANX-RALLY

Upside Catalysts (invalidate trade idea):

A surprisingly weak jobs report that the market interprets as "bad news is good news," fueling a further liquidity-driven rally in high-beta tech.

Downside Catalysts (trigger/strengthen trade idea):

A surprisingly strong jobs report that forces the market to price out Fed cuts, hurting long-duration growth stocks.

Any negative pre-announcements or guidance cuts from bellwether tech companies.

Escalation of US-China trade tensions specifically targeting the tech sector.

4. Risk Assessment

The primary risk to this outlook is a sudden, sharp reversal in market sentiment that invalidates the core assumptions.

Stronger-Than-Expected Data: The consensus is leaning towards a weakening US economy. A series of surprisingly robust data points, starting with a very strong NFP report (e.g., >150k jobs, rising wages), could completely unwind the dovish Fed narrative, causing a spike in yields and the USD, and a sharp drop in Gold and equities.

Political De-escalation: An unexpected resolution or calming of the political situation surrounding the Federal Reserve could remove a key pillar of the "institutional risk" narrative, reducing safe-haven demand for assets like Gold.

"Good News is Good News" Shift: The market is currently operating under a "bad news is good news" regime. A risk exists that sentiment could shift, and strong economic data could be interpreted positively for growth, invalidating the rationale for shorting equities.

5. Conclusion and Weekly Outlook

The overall market sentiment for the upcoming week is best described as anxious and fragile. While indices are near all-time highs, this strength is built on a narrow and questionable foundation: the hope of imminent Federal Reserve rate cuts. This makes the market exceptionally sensitive to the upcoming US Nonfarm Payrolls report on Friday, September 5th, which will serve as the primary catalyst and a crucial test of the dominant "Anxious Rally" narrative.

Best Case Scenario (Risk-On): A "Goldilocks" NFP report—weak enough to justify future Fed cuts but not so weak as to signal an imminent recession—could extend the "Anxious Rally." In this scenario, equities could grind higher, while the USD remains soft, and Gold holds its value on the combination of dovish policy and underlying political risk.

Worst Case Scenario (Risk-Off): A surprisingly strong NFP report could be the pin that pops the bubble. The market would be forced to rapidly price out Fed cuts, leading to a spike in Treasury yields and the US Dollar. This would likely trigger a sharp sell-off in both equities (especially tech) and Gold.

Most Likely Scenario: The NFP report comes in mixed or moderately weak (e.g., payrolls around 70k-90k, a slight tick up in unemployment). This outcome would not be decisive enough to fully confirm or deny the dovish Fed narrative, leading to significant intra-day volatility. Gold and the anti-USD trade would likely see initial strength, but the market would remain on edge, with political headlines continuing to drive sentiment and the "Anxious Rally" narrative moving closer to a potential peak (Stage 6).

Monitoring the evolution of the Fed's political independence narrative and the market's reaction to the jobs data will be essential for navigating the volatile week ahead.

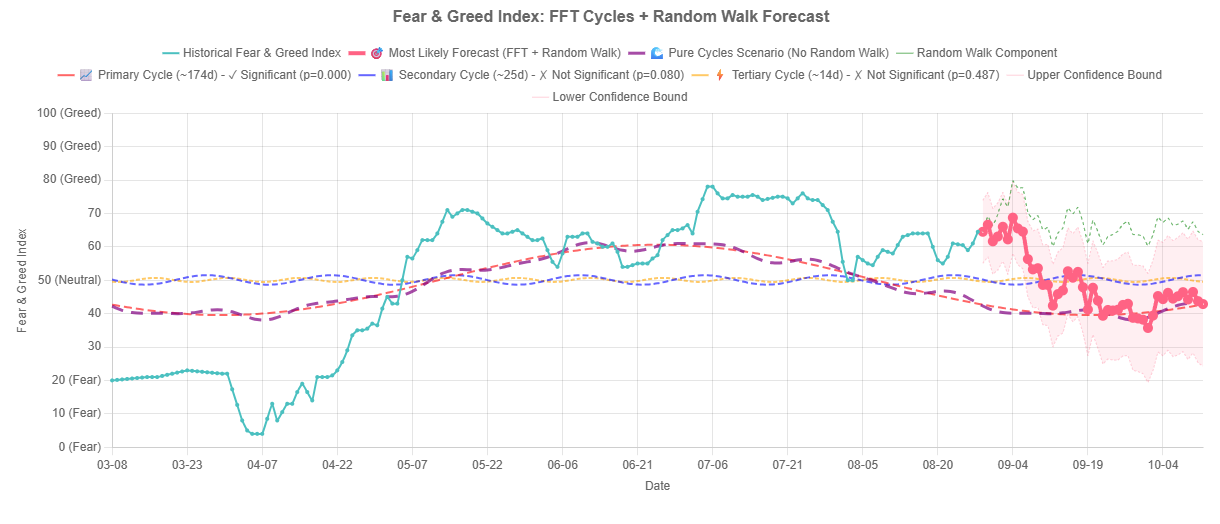

Now we look the Fear and Greed sentiment forecast today`s reading was 64. The model predicted 63

The forcast finds it`s peak at the 5th of September, NFP day.

I`m not telling anything just showing data and there is always HEADLINE RISK with TRUMP

weeklymarketreport is coming soon !