narrative. done.

Greetings,

If you haven't guessed already, my superpower is integration. For 25 years, I have integrated and automated businesses and their "processes." I'm using my superpower to learn trading, to learn macro, because you cannot integrate anything you do not understand.

And yet, there is this one thing in trading every trader needs to do: get size on and look deep into the screens. So, I hope this was the last weekend I spent on narrative integration. Yet, I'm not quite satisfied with the result, but maybe there is no need for enhancement... to be decided. I am now creating three narrative blocks: one from the major news agencies (Bloomberg, Reuters, Axios), one from the WSJ, and one from a few traders like Chris Weston. The idea behind this is to gain conviction and transform narratives into instruments or markets in question. Then, in a next step, the found markets and bespoke ideas need backup from technical analysis and correlations (I haven't done the technicals yet). Maybe you now get to where this will lead.

The actual Yield Curve analysis is available here (bloody email limit of substack): Yield Curve

Narrative analysis and comparison :

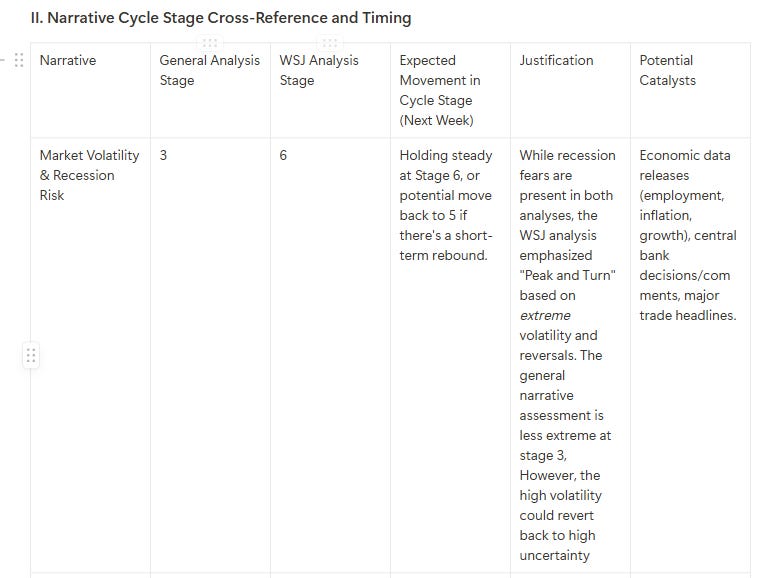

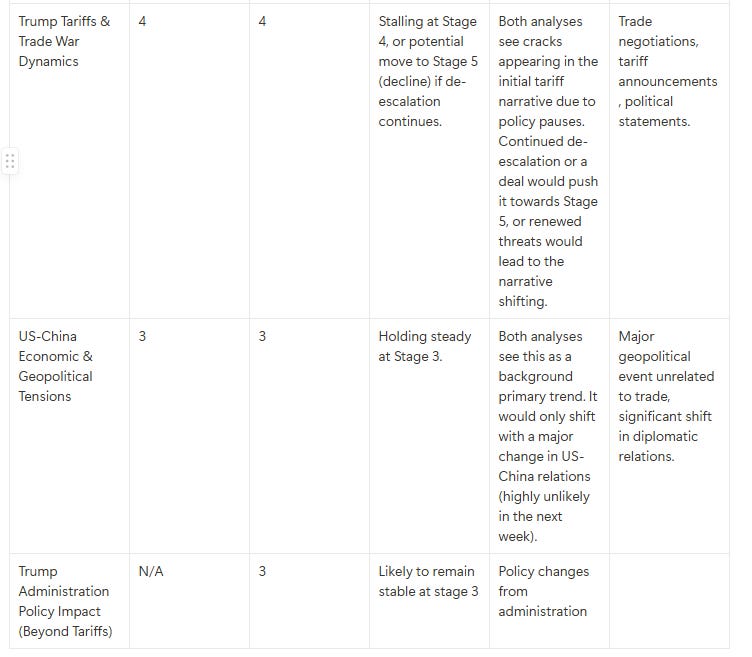

Here's a comprehensive market outlook for the upcoming week (next 5-7 trading days), synthesizing the three provided analyses: Large News Agency Narratives, WSJ Narrative Cycle, and Trader News Analysis.

III. Instrument-Specific Analysis and Actionable Opportunities

Here's a prioritized list of actionable trading opportunities for the upcoming week, integrating the narrative analysis with the Trader News Analysis data.

Key to Narrative Alignment:

SCD: Supply Chain Disruption & Realignment

CSR: China's Strategic Response

ESH: Erosion of US Safe-Haven Status

CBP: Central Bank Policy Response

RFT: Recession Fears (Trade-Driven)

TPU: Trade Policy Uncertainty & Volatility

Prioritized Trading Opportunities

Trading Action: Short / Sell Rallies

Instrument(s): S&P 500 Futures, NASDAQ Futures

Entry: Fade rallies, especially near resistance or on signs of exhaustion.

Rationale: Strong consensus on negative impact of trade tensions and high volatility. DailyFX explicitly calls rallies 'bear market rallies' and highlights fundamental concerns (real rates, earnings). NewsSquak shows sharp downside reactions to negative news. WSJ analysis indicating Stage 6 for market volatility and recession risk.

Time Sensitivity: Short-term tactical, highly dependent on trade news flow and volatility levels.

Confidence Level: High

Narrative Alignment: TPU (primary driver), RFT, SCD (indirectly through earnings risk), CBP (negative impact of rising real yields)

Upside Catalysts (invalidate trade idea): Announcement of comprehensive trade deal, strong positive earnings surprises, significant stimulus measures.

Downside Catalysts (trigger/strengthen trade idea): Renewed tariff threats, weak economic data, negative earnings revisions.

Trading Action: Short / Sell Rallies

Instrument(s): USD/CHF, USD/JPY

Entry: Sell rallies, follow confirmed downtrends.

Rationale: Explicit trade idea from DailyFX (ID:2832, ID:154) based on haven dynamics and rising real rates impacting USD negatively. NewsSquak notes DXY slumps on specific negative news (retaliation).

Time Sensitivity: Short to Medium-term, dependent on relative haven appeal and real rate trajectory.

Confidence Level: High

Narrative Alignment: ESH (USD losing haven status), TPU, RFT (flight to safety)

Upside Catalysts (invalidate trade idea): Strong US economic data, hawkish Fed commentary, de-escalation of trade tensions.

Downside Catalysts (trigger/strengthen trade idea): Escalation of trade tensions, weak US economic data, dovish Fed commentary, global recession fears.

Trading Action: Long / Buy

Instrument(s): Gold (XAU/USD)

Entry: Buy on dips or hold existing longs.

Rationale: Strong consensus on haven status. DailyFX provides explicit rationale regarding strong demand and superior hedging qualities compared to bonds in the current volatile environment.

Time Sensitivity: Short to Medium-term, linked to persistence of geopolitical uncertainty and risk aversion.

Confidence Level: High

Narrative Alignment: ESH (alternative to USD/Treasuries), RFT, TPU

Upside Catalysts (trigger/strengthen trade idea): Increased geopolitical tensions, weak economic data, significant market sell-off, dollar weakness.

Downside Catalysts (invalidate trade idea): Significant de-escalation of trade tensions, strong US economic data, hawkish Fed commentary, risk-on sentiment.

Trading Action: Short / Sell

Instrument(s): AUD/USD

Entry: Sell rallies or follow downward momentum.

Rationale: Explicit trade idea from DailyFX based on AUD acting as a proxy for CNH weakness and general risk aversion impacting high-beta FX.

Time Sensitivity: Short-term tactical, highly sensitive to risk sentiment and China/CNH developments.

Confidence Level: Medium-High

Narrative Alignment: CSR (CNH depreciation as policy tool), RFT, TPU

Upside Catalysts (invalidate trade idea): Announcement of trade progress, CNH strength, positive Australian economic data, commodity price rally.

Downside Catalysts (trigger/strengthen trade idea): Further CNH depreciation, escalation of trade tensions, negative Australian economic data, decline in commodity prices.

Trading Action: Short / Sell

Instrument(s): Crude Oil (WTI/Brent)

Rationale: Both sources link Crude to risk sentiment and growth fears driven by tariffs. DailyFX mentions sell-offs linked to recession risk. Acts as a proxy for global growth concerns.

Time Sensitivity: Short to Medium-term, aligned with risk sentiment and growth outlook.

Confidence Level: Medium

Narrative Alignment: RFT, TPU, SCD (potential impact on demand)

Upside Catalysts: Unexpected OPEC production cuts, de-escalation of trade tensions, strong global economic data.

Downside Catalysts: Negative economic data releases (PMIs, GDP), increased recession fears, rising US crude inventories.

High Volatility Environment: Given the dominant "Trade Policy Uncertainty & Volatility" narrative (Stage 4) and the "Market Volatility & Recession Risk" narrative (Stage 6 - WSJ), consider the following strategy:

Trading Action: Long / Utilize Volatility Instruments

Instrument(s): VIX futures, VIX options, Equity Index Options (buying puts/selling calls)

Entry: Not specified, but implied to hold or enter longs while drivers persist.

Rationale: Extreme volatility is a central theme in both sources. DailyFX explicitly suggests using VIX/options as a hedge or trading tool, highlighting levels >40-50 as significant.

Time Sensitivity: Short-term tactical, directly linked to market uncertainty and geopolitical news flow.

Confidence Level: High

Narrative Alignment: TPU, RFT *Upside Catalysts: Further escalation in trade war, geopolitical tensions *Downside Catalysts: Trade deal and resolution of conflict between US and China

IV. Risk Assessment and Mitigation

Invalidation Risks:

Sudden Trade Deal Resolution: A comprehensive agreement between the US and China would significantly alter the market landscape, invalidating bearish positions and boosting risk assets.

Unexpected Policy Changes: Surprises from central banks (e.g., a coordinated easing effort exceeding market expectations) or governments (e.g., significant fiscal stimulus) could shift sentiment rapidly.

Strong Economic Data: Unexpectedly strong economic data could temporarily quell recession fears and support risk assets, negating bearish trades.

V. Conclusion and Weekly Outlook

Overall Market Risk Sentiment: Risk-off bias prevails. The dominant narratives of "Trade Policy Uncertainty & Volatility" and "Recession Fears" are expected to continue to weigh on markets. "Market Volatility & Recession Risk" are at their Peak.

Key Drivers for the Upcoming Week:

Trade Negotiations: Any news or rumors regarding US-China trade negotiations will be a major market mover. Watch for official statements and leaks.

Economic Data: Economic data releases (PMIs, employment, inflation) will be closely watched for signs of economic slowdown.

Central Bank Commentary: Commentary from central bank officials (Fed, ECB) will be scrutinized for clues about future policy actions.

Geopolitical Events: Monitor any geopolitical events that could trigger risk aversion.

Potential Roadmap for Market Developments:

Continued Volatility: Expect continued high volatility as markets react to trade news and economic data.

Flight to Safety: Safe-haven assets (Gold, CHF, JPY) are likely to benefit from risk aversion.

Equity Weakness: Equities are likely to remain under pressure, with rallies viewed skeptically.

Commodity Price Weakness: Crude oil and other commodities are likely to be negatively impacted by concerns about global growth.

China policy expected to continue easing.

Important Disclaimer: This analysis is based on the provided data and should not be considered financial advice. Trading involves risk, and it is essential to conduct your own research and consult with a financial advisor before making any investment decisions. The suggested entry/target/stop levels are illustrative and should be adjusted based on individual risk tolerance and market conditions. Remember, markets can change rapidly, and past performance is not indicative of future results.